What Is Double Entry Bookkeeping And How Does It Work?

Author: ChatGPT

March 13, 2023

Introduction

Double entry bookkeeping is an accounting system that requires two entries for every transaction. It is the most common form of bookkeeping used by businesses today and is based on the concept of debits and credits. The double entry system ensures accuracy in financial records, as each transaction must be recorded twice in order to balance the books. In this blog post, we will discuss what double entry bookkeeping is, how it works, and why it’s important for businesses to use this system.

What is Double Entry Bookkeeping?

Double entry bookkeeping is a method of recording financial transactions that requires two entries for each transaction. This means that when a business makes a purchase or sale, they must record both the debit (the amount spent) and the credit (the amount received). This ensures accuracy in financial records as each transaction must be recorded twice in order to balance the books. The double entry system also helps to prevent fraud by ensuring that all transactions are properly documented and accounted for.

How Does Double Entry Bookkeeping Work?

The double entry system works by recording both debits and credits for each transaction. When a business makes a purchase or sale, they must record both the debit (the amount spent) and the credit (the amount received). This ensures accuracy in financial records as each transaction must be recorded twice in order to balance the books. The double entry system also helps to prevent fraud by ensuring that all transactions are properly documented and accounted for.

The double entry system works by using two accounts: one account for debits (assets) and one account for credits (liabilities). When a business makes a purchase or sale, they must record both the debit (the amount spent) and the credit (the amount received). This ensures accuracy in financial records as each transaction must be recorded twice in order to balance the books. For example, if a business purchases inventory from another company, they would record a debit to their inventory account and a credit to their accounts payable account.

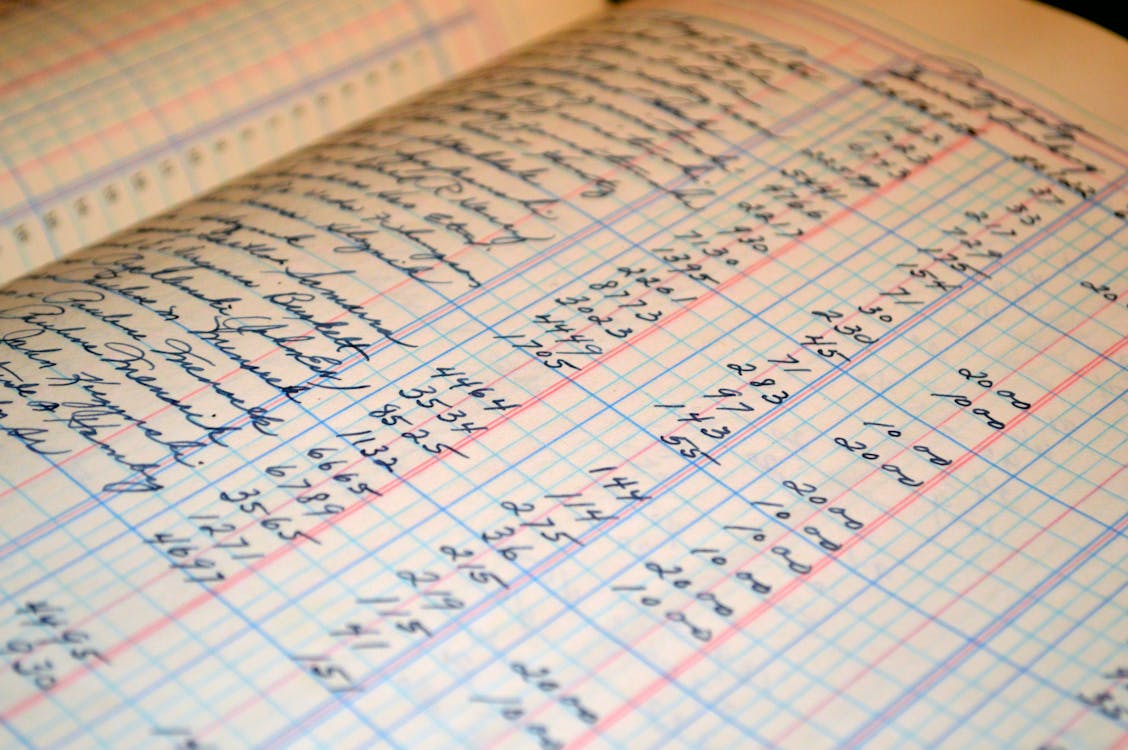

The General Ledger

The general ledger is an important part of double entry bookkeeping as it serves as an overall summary of all transactions made within an accounting period. The general ledger contains all of the accounts used within an organization’s accounting system including assets, liabilities, equity, income, expenses, etc. All transactions are recorded into these accounts which are then summarized into one overall statement known as the general ledger. The general ledger provides an overview of all financial activity within an organization which can then be used to make informed decisions about future investments or expenditures.

Why Use Double Entry Bookkeeping?

Double entry bookkeeping provides businesses with accurate financial records which can be used to make informed decisions about future investments or expenditures. It also helps prevent fraud by ensuring that all transactions are properly documented and accounted for. Additionally, double entry bookkeeping allows businesses to easily track their finances over time which can help them identify areas where they may need improvement or where they may have made mistakes in their accounting practices. Finally, using double entry bookkeeping allows businesses to easily prepare their taxes at year end since all of their financial information will already be organized into one comprehensive statement known as the general ledger.

In conclusion, double entry bookkeeping is an essential tool for any business looking to accurately track their finances over time while also preventing fraud through proper documentation of all transactions made within an accounting period. By understanding how this system works and why it’s important for businesses to use it correctly, companies can ensure that their finances remain accurate while also making informed decisions about future investments or expenditures based on reliable data from their general ledger statement

How Long Does It Take To Sell Stock And Get Money?

Discover the answer to one of the most frequently asked questions in the world of finance - learn how long it takes to sell stock and receive your earnings.

What Are High Dividend Stocks?

Discover how investing in high dividend stocks can potentially provide a steady income stream and increase your long-term returns in the stock market.

Are Data Science And Machine Learning The Same?

Data science is a field of study that focuses on extracting insights from large amounts of data. It involves using various techniques such as machine learning, natural language processing, statistics, and data mining to analyze data sets and uncover patterns or trends.

Are Remarkable Tablets Worth It?

Are you looking for a device that can replace your notebooks and printed documents? If so, you may have heard of the reMarkable 2 tablet.